CFO’s and Controllers Know – The Journey Towards Mandated ESG Reporting Starts Now

Accelerate regulatory reporting, deal making, data protection and management of risk compliance.

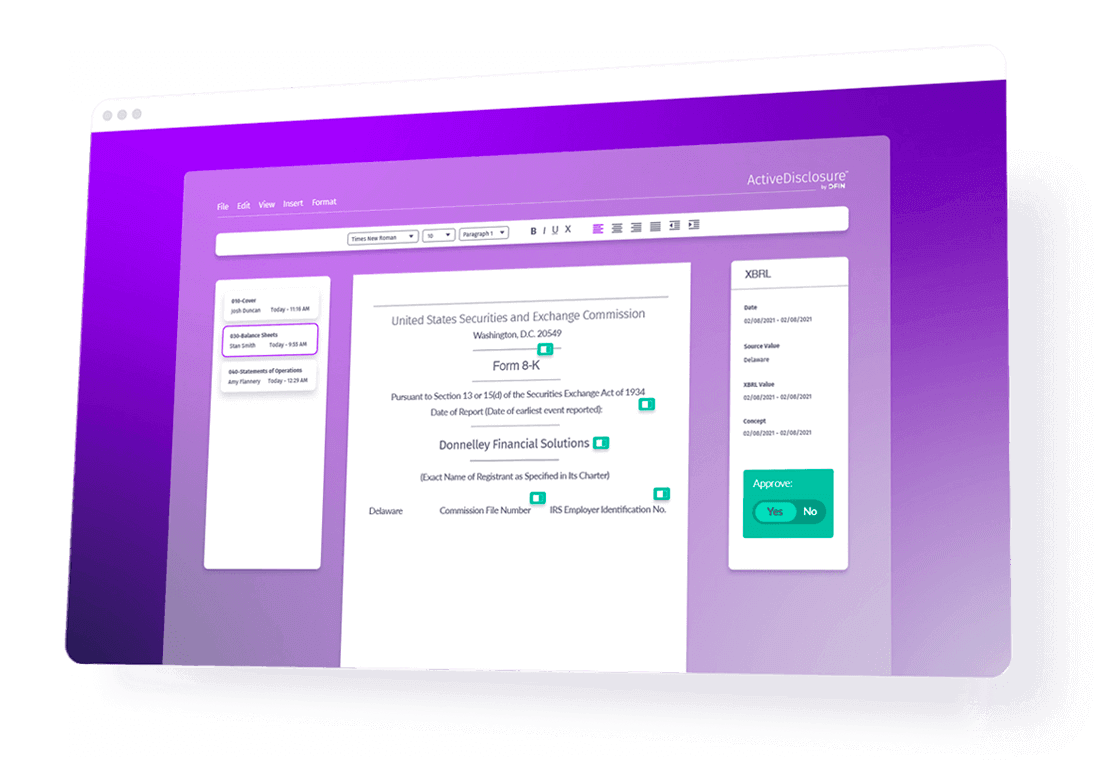

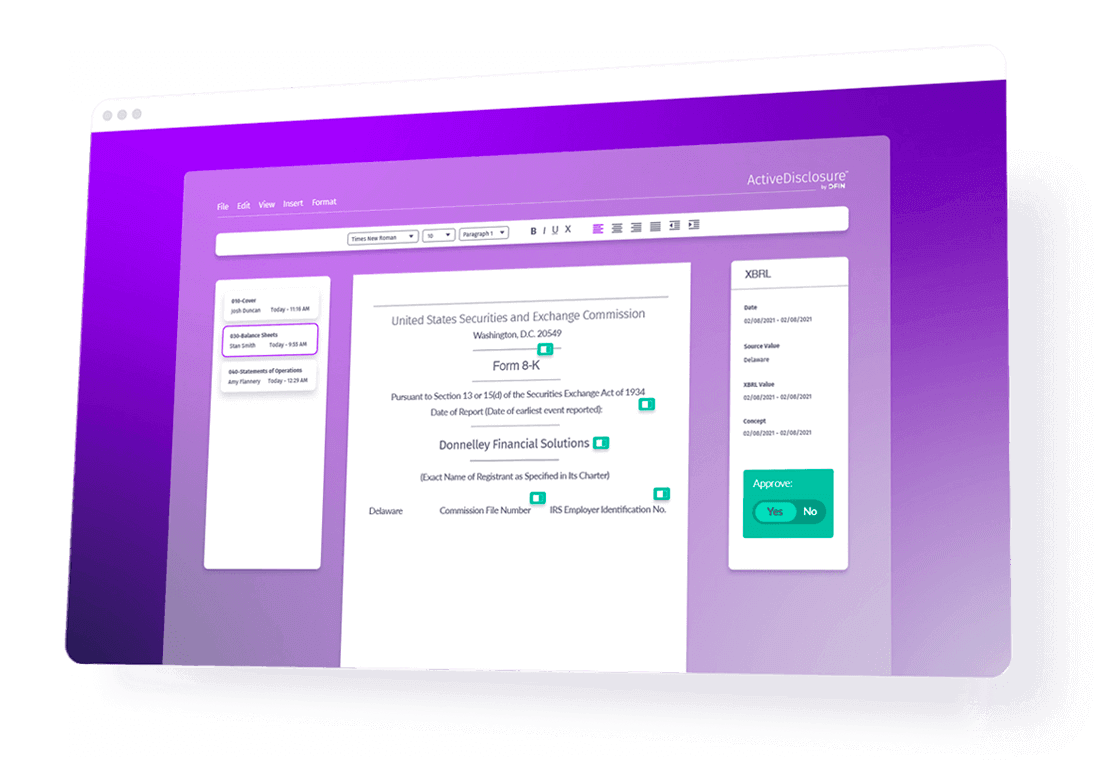

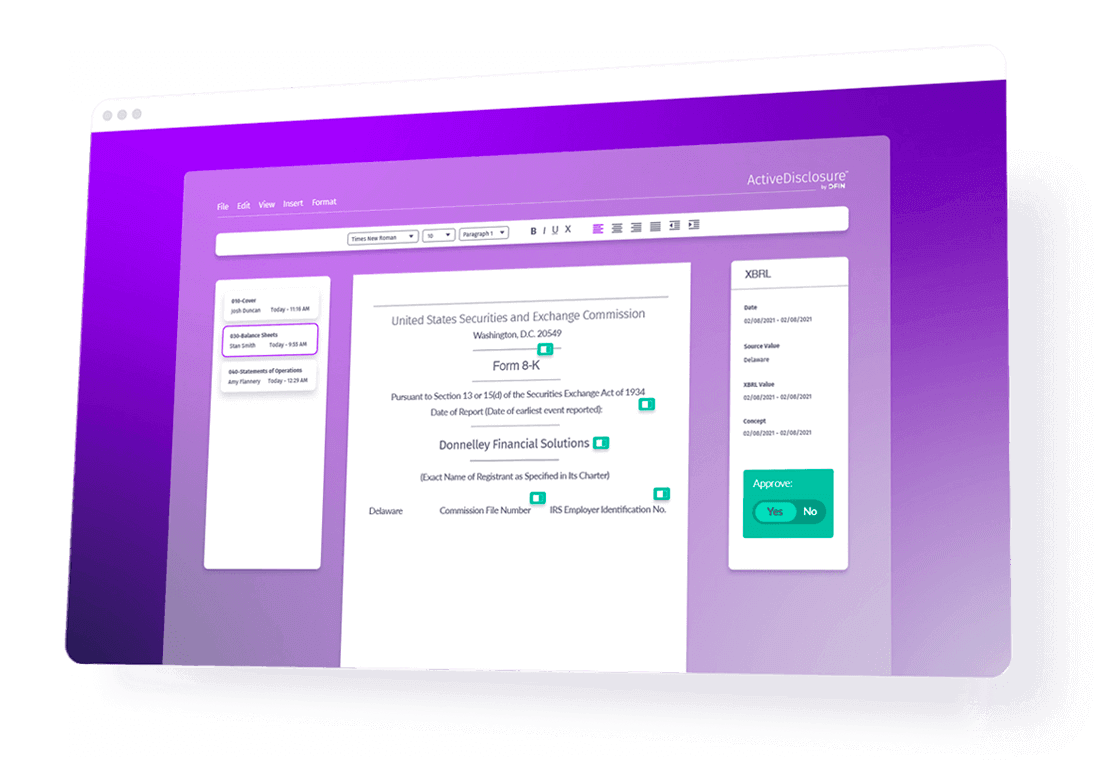

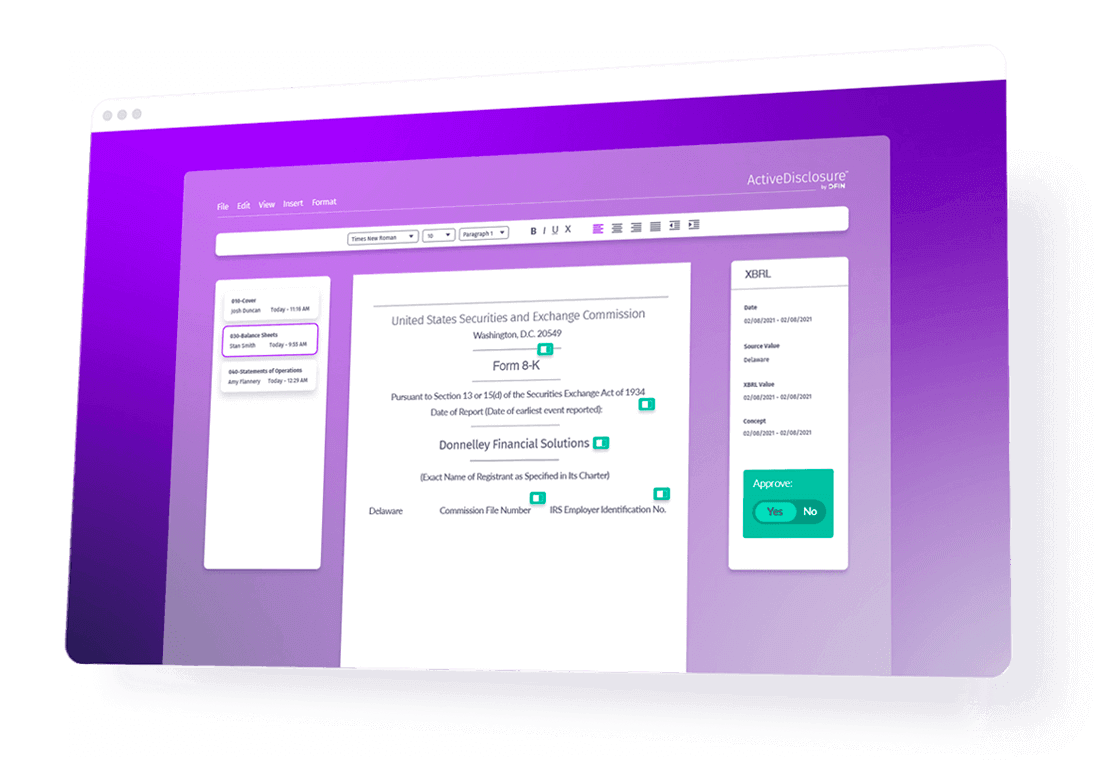

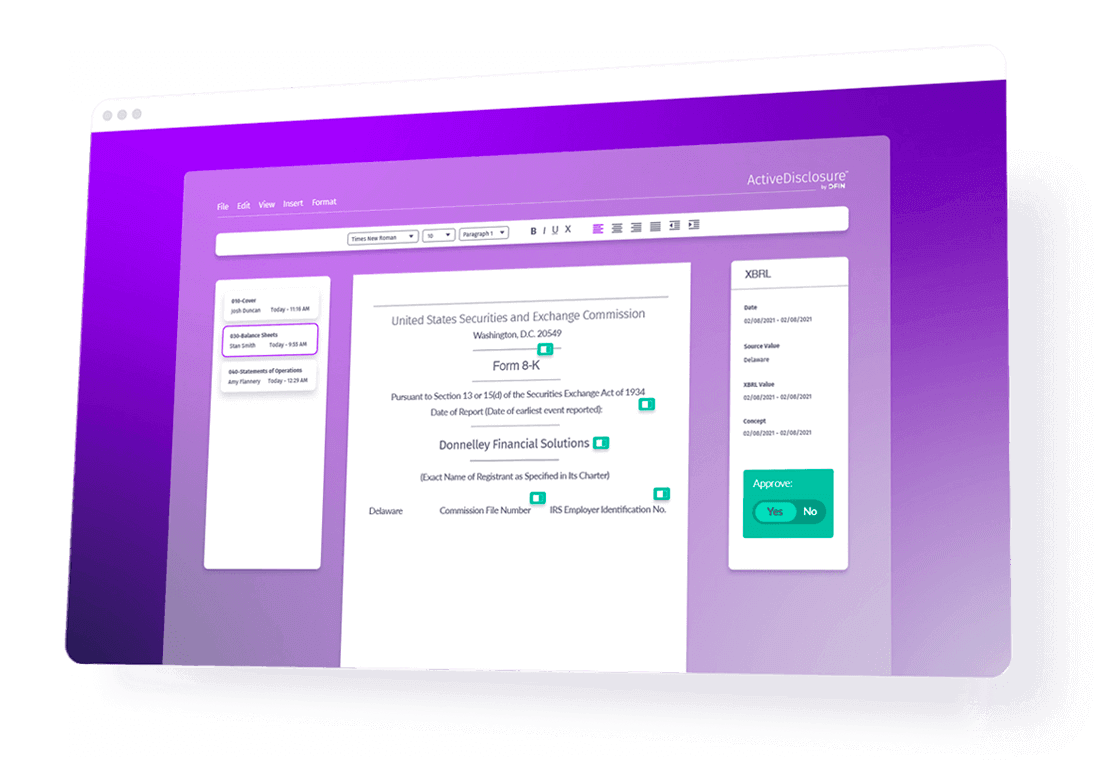

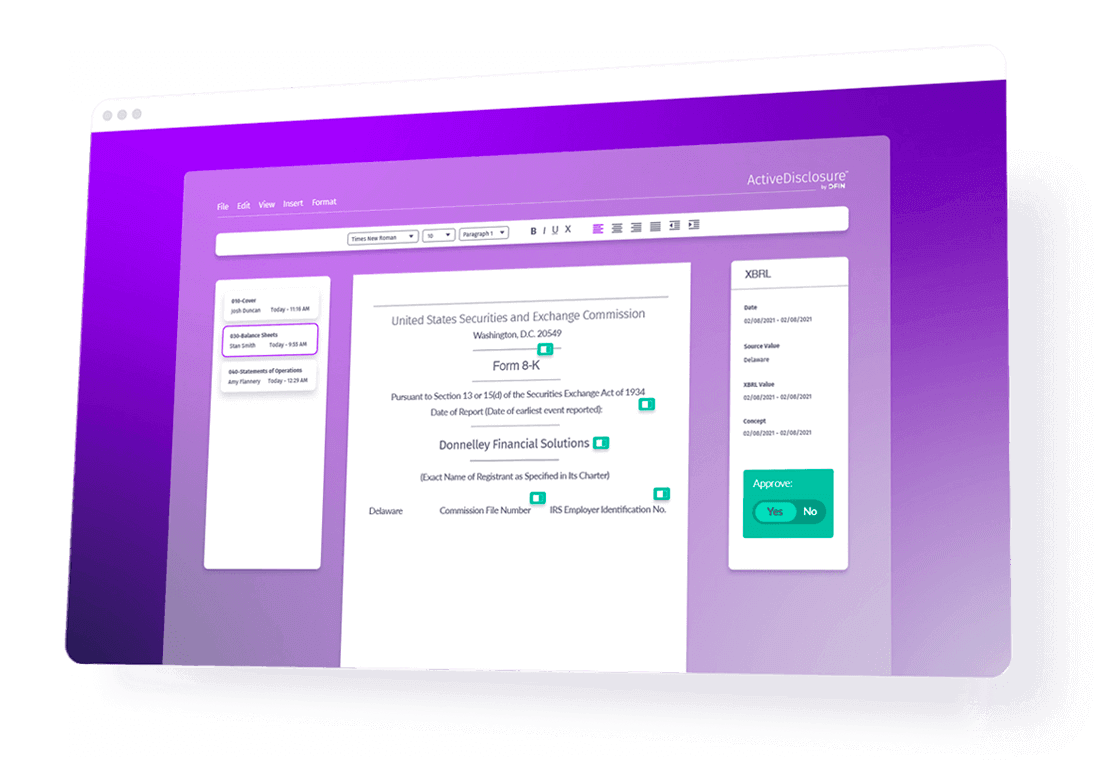

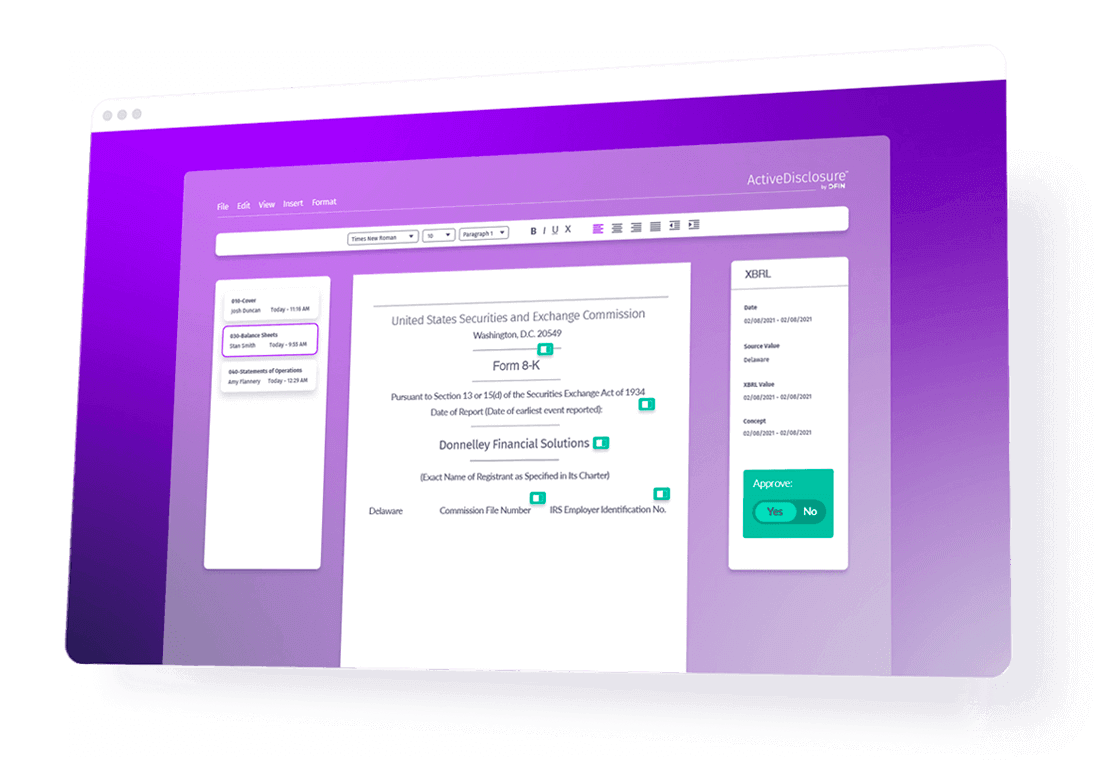

ActiveDisclosure

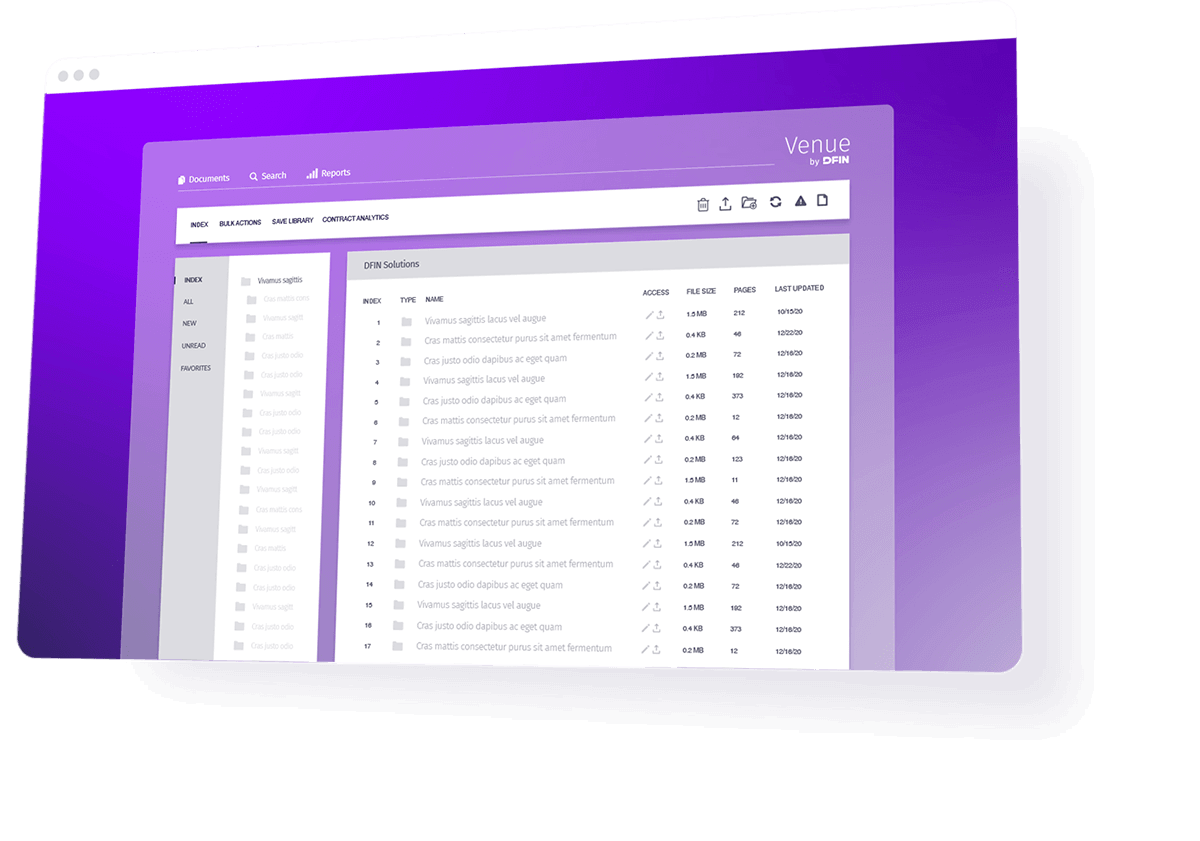

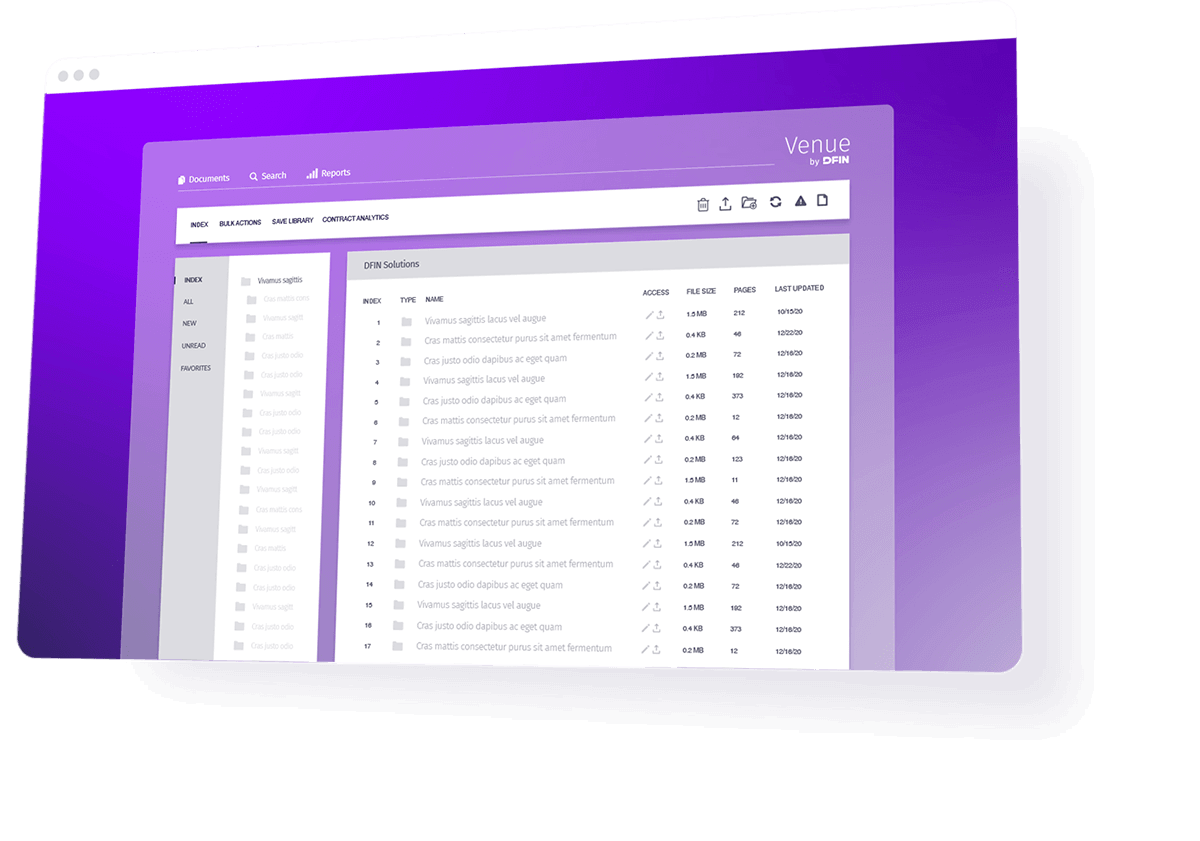

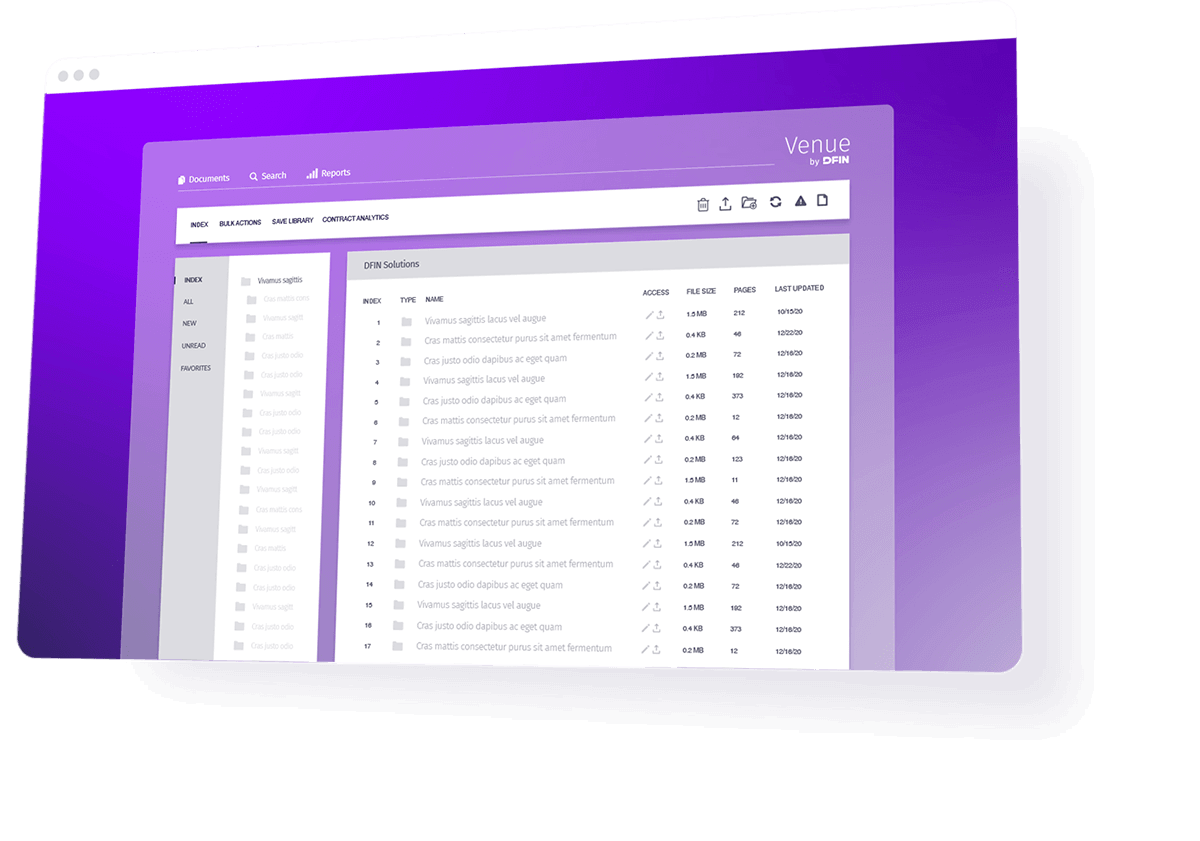

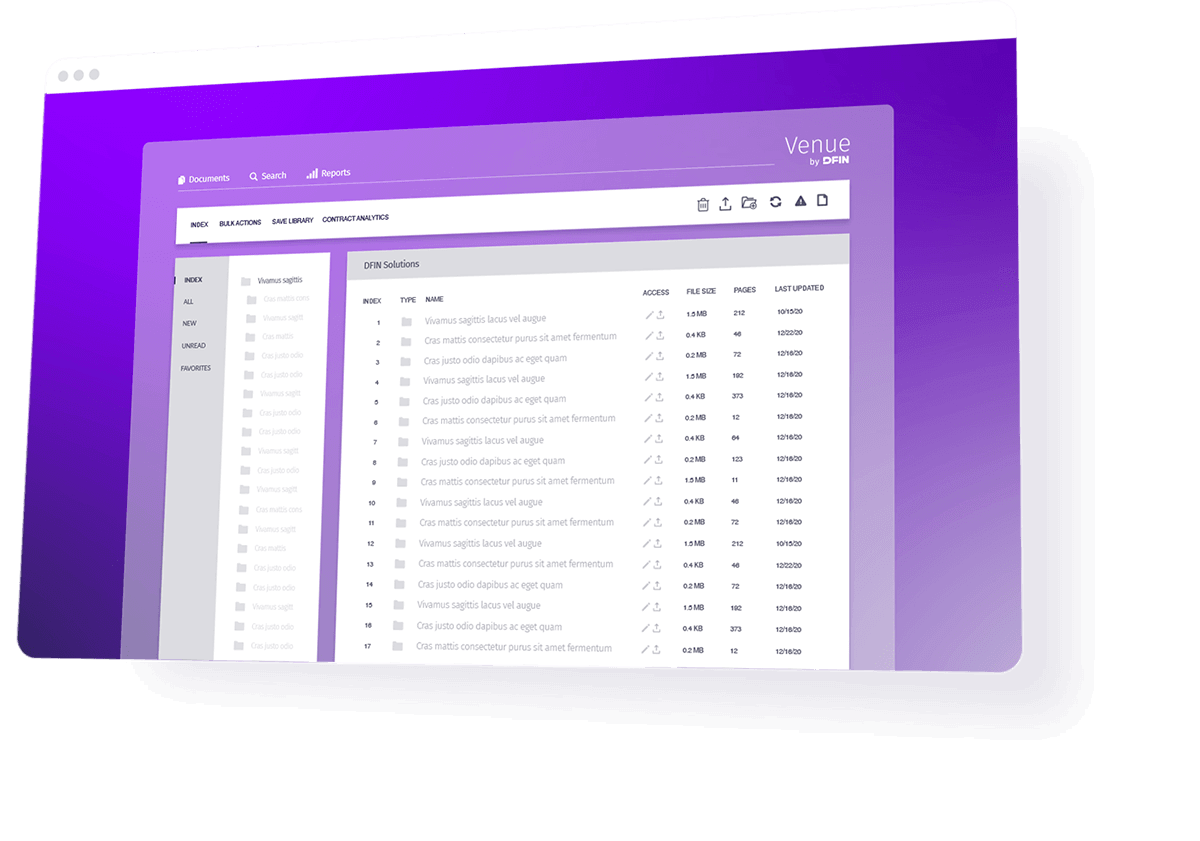

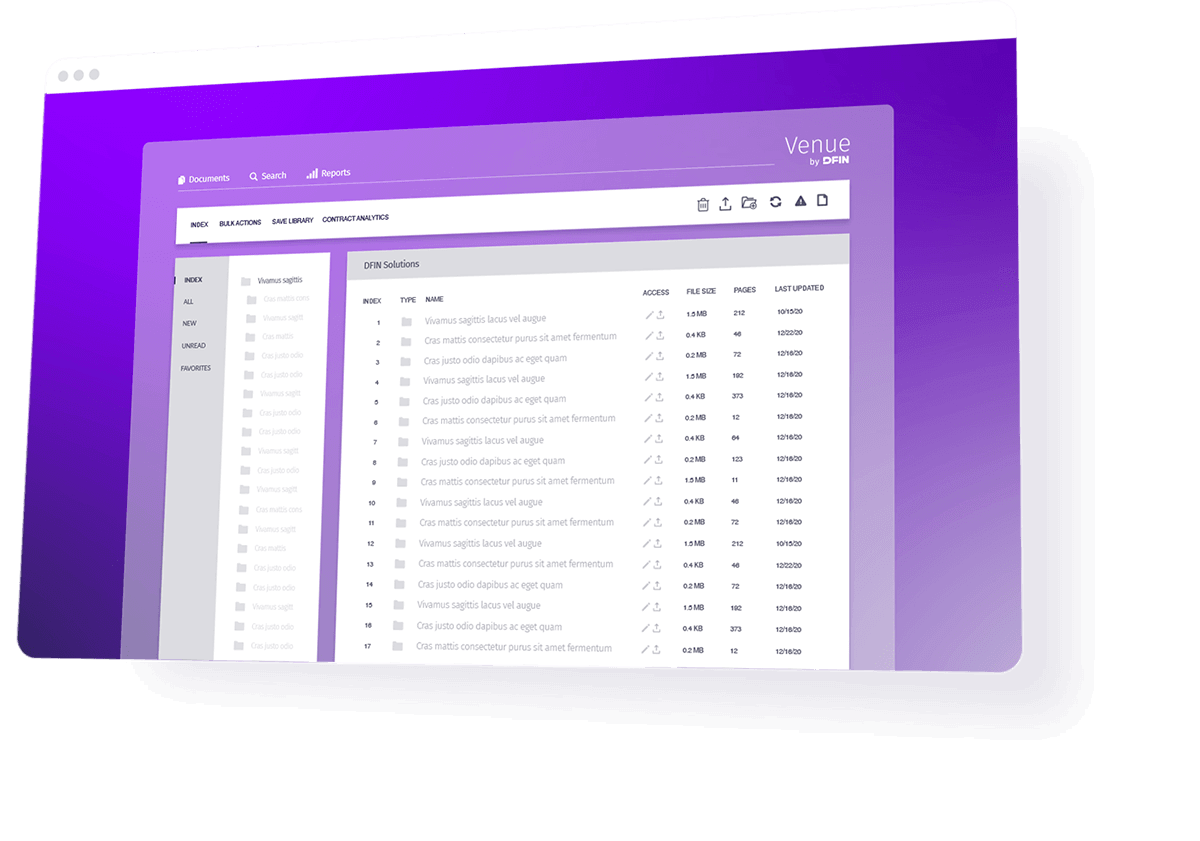

Venue

M&A

Meet financial and regulatory requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

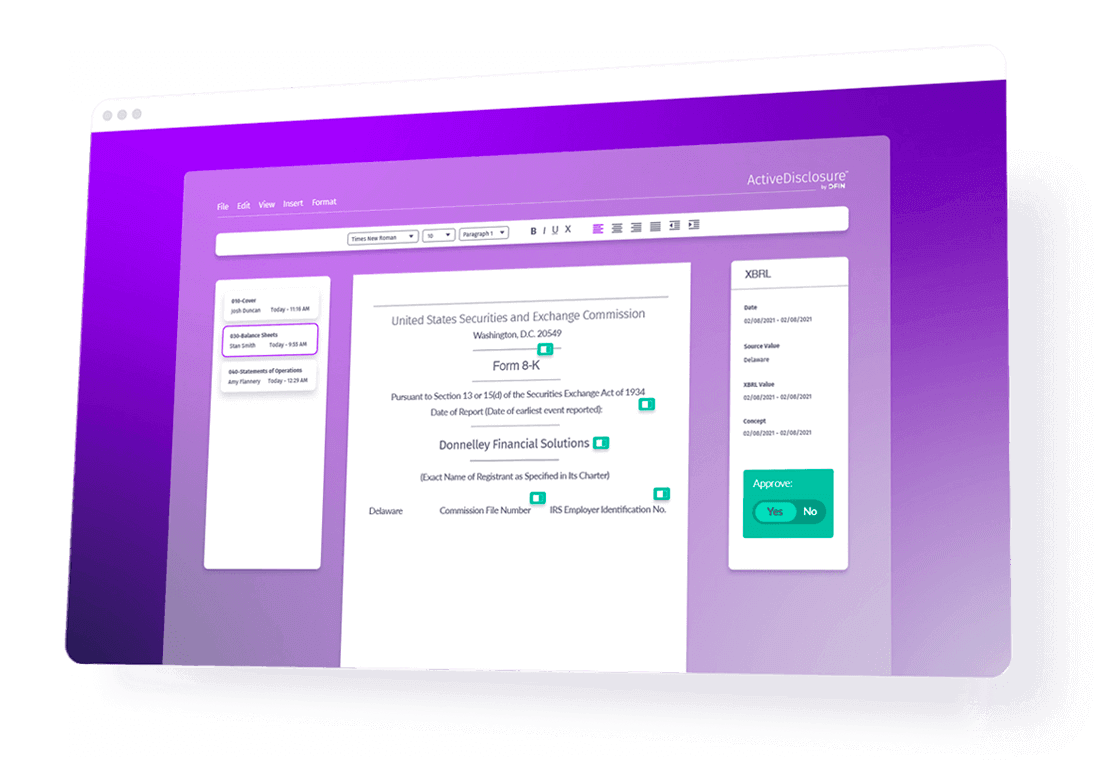

ActiveDisclosure

Venue

M&A

IPO

Meet financial reporting requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

M&A

IPO

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

M&A

IPO

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

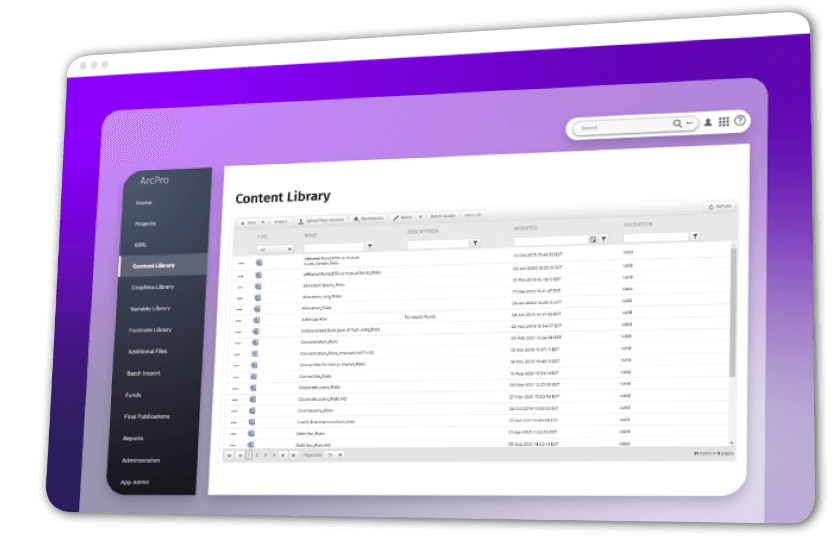

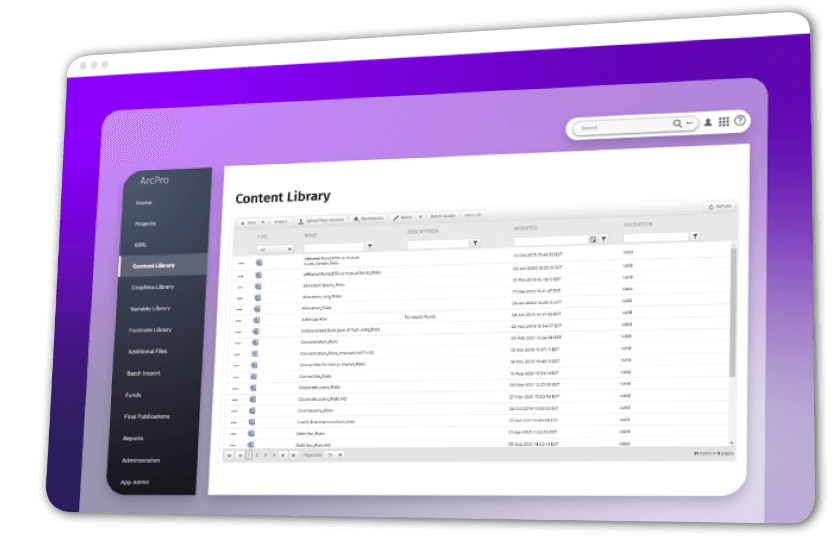

ArcPro

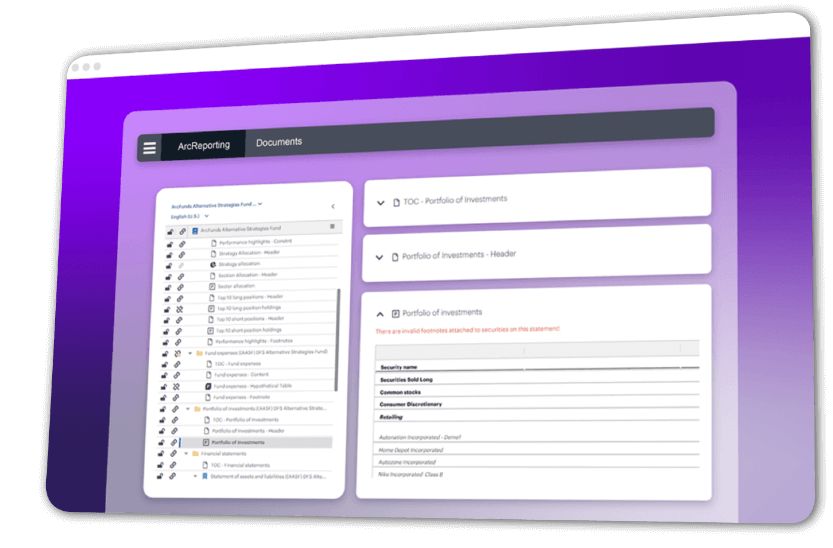

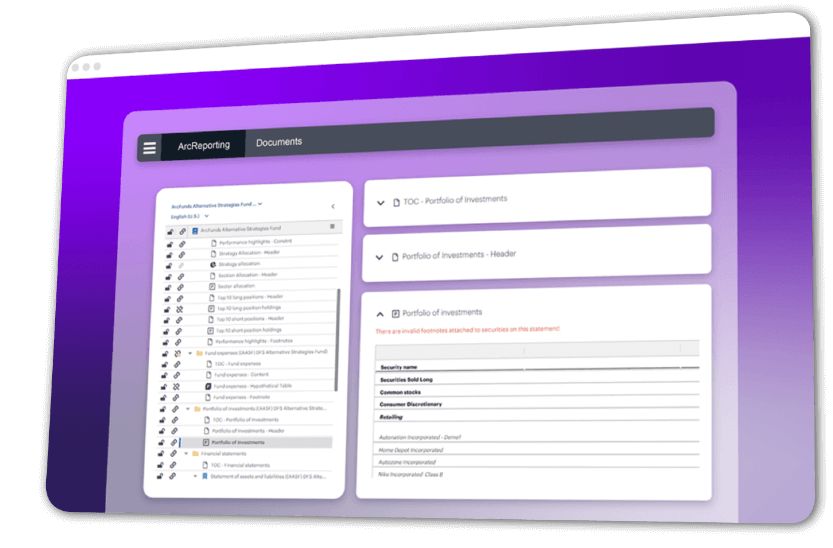

ArcReporting

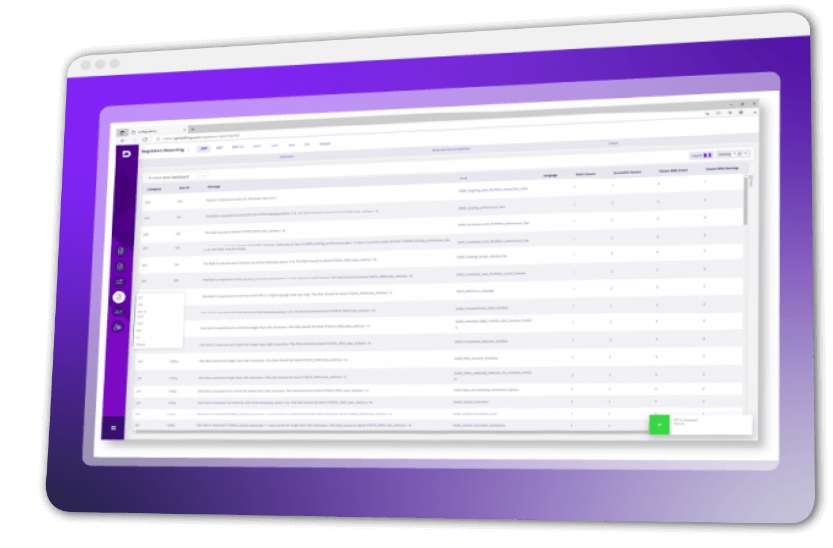

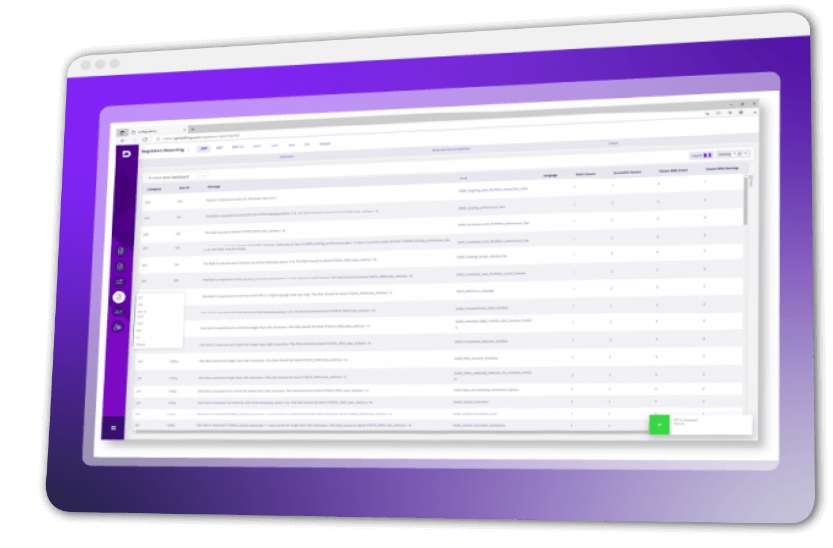

ArcRegulatory

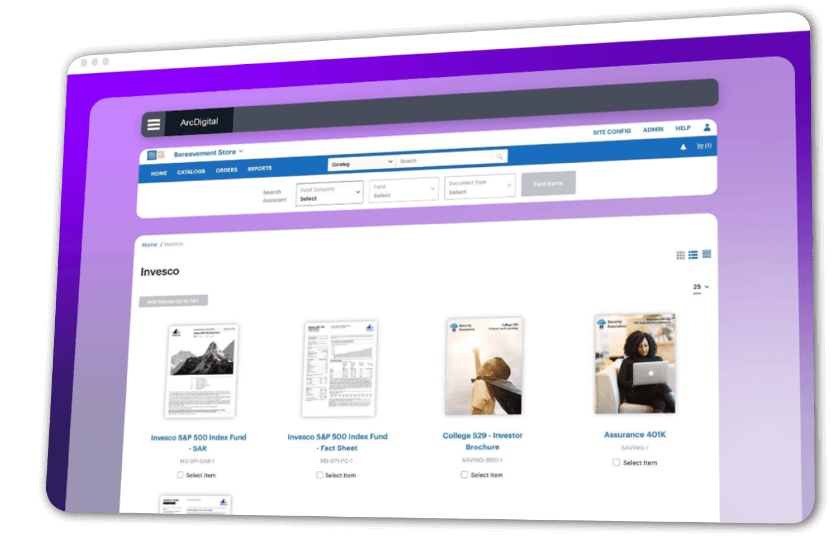

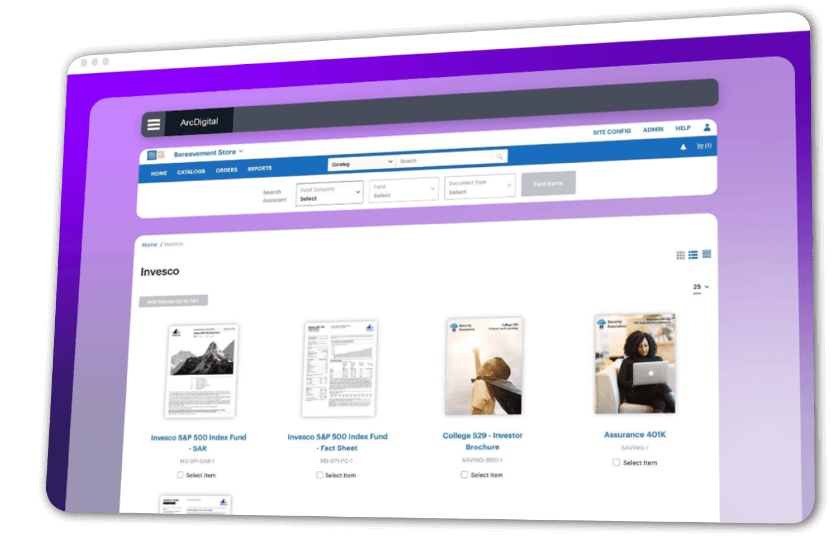

ArcDigital

Automate the process for creating and updating shareholder documents. Use your own desktop tools and get professional publishing output that’s clean, tagged and ready on time.

Intuitive tools that help you manage complex data and content across documents to create and file high-quality, consistently stylised regulatory documents for the funds industry.

Experience DFIN’s innovative global regulatory platform for complete transparency over your regulatory requirements in Europe including PRIIPs, MiFID II and PRIIPs KID reporting.

Staying compliant has never been easier. From a centralised document repository, to compliance material tracking and digital asset management, ArcDigital is your one-stop shop for compliance management.

Choose your line of business

ActiveDisclosure

Meet financial and regulatory requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

ActiveDisclosure

Meet financial reporting requirements accurately and securely with Excel-based, single-source data management, easy team collaboration and improved workflows.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

IPO

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

IPO

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

Venue

Venue secure VDR and data room services help streamline M&A diligence, improve negotiations and reduce cost for strategic transactions with data privacy protection, auto-redaction capabilities and self-launching data rooms.

M&A

Optimise the M&A process. End-to-end deal solutions from providing artificial intelligence used during the diligence process to providing regulatory expertise and post-merger integration tools.

IPO

Our always-on ecosystem of support simplifies your IPO listing on any major global exchange. We deliver speed, control, expertise and accuracy through every step of the process, from drafting your IPO prospectus to post-IPO financial report and SOX controls.

ArcPro

Automate the process for creating and updating shareholder documents. Use your own desktop tools and get professional publishing output that’s clean, tagged and ready on time.

ArcReporting

Intuitive tools that help you manage complex data and content across documents to create and file high-quality, consistently stylised regulatory documents for the funds industry.

ArcRegulatory

Experience DFIN’s innovative global regulatory platform for complete transparency over your regulatory requirements in Europe including PRIIPs, MiFID II and PRIIPs KID reporting.

ArcDigital

Staying compliant has never been easier. From a centralised document repository, to compliance material tracking and digital asset management, ArcDigital is your one-stop shop for compliance management.

SEC Filing Agent for Corporations

2021 Market Share of Large Transaction Filings

Fortune 1,000 Clients in 2021

Get in touch with us for support, pricing or more information.

or

call +44 203 047 6100

Security and Compliance First

Discover how DFIN enables clients to boost productivity, improve processes and deliver better results.

VIDEO PODCAST

Watch as DFIN’s CISO shares the latest security trends, strategies for data protection and how DFIN’s advanced security protocols protect client data.

Current M&A activity levels have been significantly affected by inflationary costs and debt availability compared to the peak experienced post-COVID. While M&A activity in EMEA has decreased drastically in the last year, Q2’23 saw the beginnings of a potential trend of increased deals after a year of steady decline.

Read now